Nonprofit organizations make the world a better place. It is hard to imagine what our communities would do without their selfless, unrelenting dedication to society. Unlike some organizations that exist to generate profits, nonprofit organizations solely function for societal welfare. Their service is significant across religious, educational, commercial, health, sports, and social service sectors. Understandably, financial gain is not their objective. Nevertheless, it is a necessity to further their cause and scale their mission.

Most nonprofit organizations are financially supported by generous donors and philanthropists who contribute substantial sums of money to their missions. They are also assisted by leading virtual accounting firms in the US that help them manage their accounts with ease. When an organization receives money, it has a fiduciary responsibility to show donors the status of its financial resources. If you are a nonprofit that has just started, you have to be very clear about your financial statements from the word 'go.' What we are talking about here is - Concise, Clear, Accurate, and Auditable records. Every income and expense must tally, right down to the last number. There are reasons why we are emphasizing this:

Running a nonprofit organization is no child's play. You are answerable to your donors, auditors, accountants, and board members. You need to be on top of the game with your financial report statements that showcase your revenue and expenses.

We list some of the most significant features below :

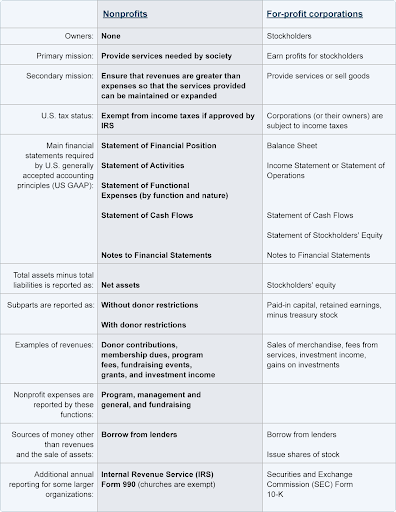

Since nonprofits do not have owners, there is no owner's equity or stockholders' equity and therefore no distributions to owners.

Some people mistakenly assume that if an organization is designated as a nonprofit, it cannot legally earn profits. In fact, having revenues in excess of expenses is almost a necessity for a nonprofit if it hopes to withstand such things as:

Nonprofit organizations may apply to the Internal Revenue Service in order to be exempt from federal income taxes.

You can learn more about the tax-exempt status for a nonprofit, the deductibility of contributions by donors, and the taxability of activities not directly related to a nonprofit's exempt purpose in the Internal Revenue Service Publication 557, Tax-Exempt Status for Your Organization, which is available at no cost on IRS.gov.

Your organization's annual report is the statement that mirrors your dedication to your cause and your astuteness in handling the finances. A transparent, well-balanced annual report can inspire and attract donors to support your organization.

Your annual report will have information relevant to your:

Perfect handling of your nonprofit's financial statements is key to keeping the entire system on track. It is a vital parameter that donors and grantmakers depend on to assess your missions and activities. Financial statements can be overwhelming if you are not familiar with their intricate nuances. Tickmarks' financial experts can help you with virtual bookkeeping and advisory services. We are happy to lend our support with our expertise. Get in touch