As we navigate the impacts of COVID-19, the auditor’s role as protector of the capital markets has never been more important. But just as clients are scrambling to secure needed funding and managing remote workforces, auditors are also facing challenges that many have never experienced.

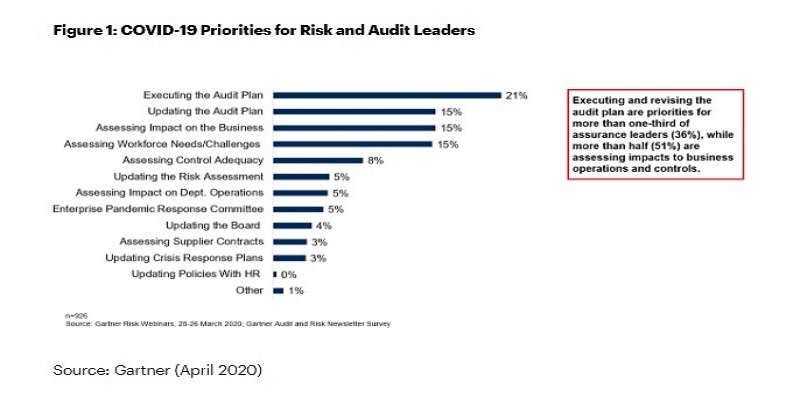

The uncertainty arising from the current environment may increase the challenge in obtaining the sufficient appropriate audit evidence needed to form an independent view about the reasonableness of management’s estimates and judgments. It is important for preparers and auditors to engage in discussions assessing the impact early in the preparation timeframe and audit process, as there are likely to be issues that have not been previously encountered that may now need to be considered. However, the priorities for risk and audit leaders differ during these unusual times

As a leading online accounting firm, we know that auditing your clients will carry unique challenges, and certain areas may present heightened risks of material misstatement for the audit. Here are some areas for auditors to consider as they prepare for their audits during these times

The COVID-19 pandemic has led to the financial situation of numerous associations to fall apart. For customers in specific businesses (e.g., cafés, cordiality) and in certain geological regions, the entity’s ability to proceed as a going concern might be raised doubt about.

One should start by assessing whether there are occasions or conditions (e.g., the pandemic) that raise significant questions that the entity can proceed as a going concern. The board is additionally required to assess the entity’s ability to proceed as a going concern. Next, request that assessment and consider whether it is complete and accurate. The look-forward period is one year from the date on which the financial statements are issued, unless otherwise specified in the financial reporting framework.

“Substantial doubt” signifies, in management’s judgment, it is likely that the client will not continue as a going concern. When substantial doubt exists, disclosure in the financial statement notes is required, regardless of whether the doubt is alleviated by management’s plans.

One rule that pervades the issues emerging from the pandemic is the utilization of estimates to ensure timely financial reporting. As mentioned below, considerable issues will require more prominent- than-usual reliance on accounting estimates; due to the higher level of uncertainty, these estimates will be inherently much difficult and less reliable.

Every time financial statements are to be issued, virtually all estimates carried from prior periods will need to be revisited in the light of COVID-19 uncertainties and developments, subject to the accounting and disclosure provisions of Accounting Standards Codification (ASC) Topic 250, “Accounting Changes and Error Corrections.”

For an accounting estimate to be accepted as reasonable by an auditor, it must be supported by sufficient objective evidence to enable a conclusion that it is based on the best information available at the time of issuance of the financial statements and is free from management bias. The latter requires careful risk assessment and the exercise of professional skepticism.

Auditors must exercise extensive professional skepticism and stay vigilant for indications of management bias in its estimates. For example, it is common to be overly conservative in a bad year when providing for loss contingencies, to facilitate improved earnings in the succeeding period.

Auditors are required to evaluate the design and implementation of controls relevant to the audit for each client. To determine whether a control is relevant to the audit, auditors should exercise their professional judgment

The client’s relevant controls may have changed dramatically during the pandemic to accommodate remote workforces and process flows. When this is the case, the auditor may be required to conduct two evaluations of the design and implementation of relevant controls: one for controls that were in place before the pandemic and another for controls put in place after the pandemic commenced. This will depend upon the nature of the control and how the pandemic affected the client’s operations.

The auditor’s evaluation of the design and implementation of relevant controls affects the rest of the audit. For example, an auditor may have historically placed reliance on the operating effectiveness of a given control. If that control stopped operating during the pandemic, such an approach may no longer be possible. In that case, the auditor may need to revise the nature, timing, and extent of substantive testing to obtain sufficient appropriate audit evidence.

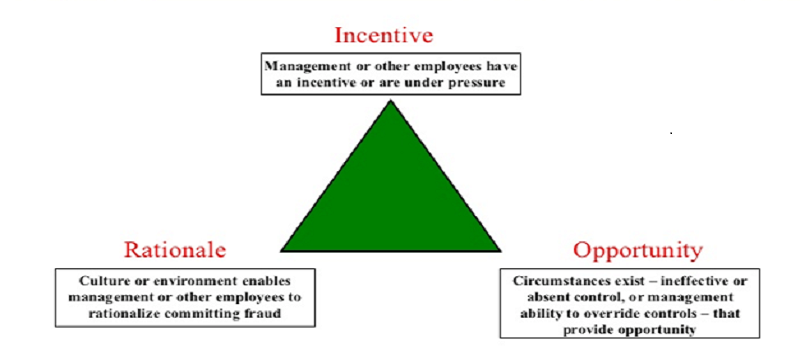

The current scenario presents a conducive environment for fraud risk, and auditors should be on high alert. Recall the three sides of the fraud risk triangle: incentives or pressure, opportunity, and rationalization.

The risk of noncompliance with laws and regulations at certain clients may be heightened. Consistent with fraud risks, audit teams should be aware of potential risks with respect to noncompliance with laws and regulations that could materially affect the financial statements. Auditor’s should consider management’s response and mitigation strategy and evaluate the appropriateness of planned further procedures in that light.

Another area that could present heightened risk for auditing is the accounting estimates. The risks related to revenue recognition could be especially acute with FASB ASC Topic 606, Revenue from Contracts With Customers, in its first year of implementation for private companies that have adopted the new standard.

In addition to estimates associated with revenue recognition, auditors may find that other audit areas, such as the allowance for doubtful accounts, may have a heightened risk of material misstatement. And for clients with goodwill or intangible assets, management may need to consider whether impairment is necessary.

Ultimately, while auditors may have been able to evaluate management’s estimates in prior years by considering historical results or other measures, audit of clients with 2020-year ends may require the use of valuation specialists.

The Senior management is required to disclose risk and uncertainties that could essentially influence (1) amounts reported in the financial statements in the near term or (2) the near-term functioning of the entity. Risk and vulnerabilities can originate from the nature of the entity’s activities, significant estimates, or current weaknesses because of specific focuses. Many entities will be required to unveil risk and vulnerabilities related with COVID-19, as the pandemic may genuinely affect significant estimates and exacerbate concentrations.

ASC Topic 855, “Subsequent Events,” and the related auditing standards (AU-C 560 and AS 2801) govern reporting on subsequent events. For audits of calendar-year-end 2019 financial statements, COVID-19-related subsequent events are likely to be Type II events (i.e., events that provide evidence of conditions that arose after the date of the financial statements). This includes declines in the fair value of investments.

While these instances would not require recognition in the financial statements, disclosure may be required. Auditors should assess the appropriateness of the subsequent-event disclosures in the financial statements, and if an appropriate disclosure is not made, a modified auditor’s opinion may be appropriate.

For audits of clients with year ends that fall in 2020, pandemic-related events may require adjustments to the financial statements or additional disclosures as Type I events (i.e., events that provide evidence of conditions that existed at the date of the financial statements).

At all times auditors will have to exercise significant professional judgment and professional skepticism and must remain focused on their ethical responsibilities and public interest.

Auditors are also required to consider all national legal and regulatory requirements and comply with the fundamental principles (integrity, objectivity, professional competence and due care, confidentiality, and professional behavior), that is key to preserve and expand public trust in all auditors.